Trends in cell therapy clinical trial data — a 5-year analysis

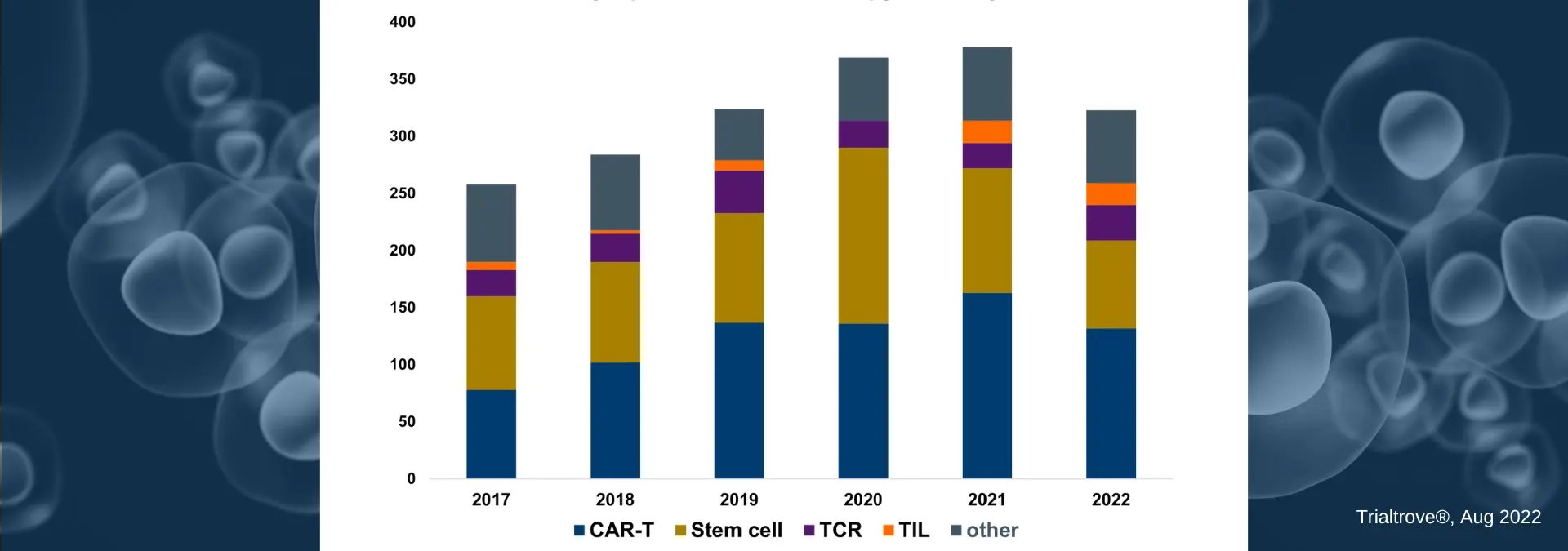

From treating cancers, autoimmune diseases, urinary problems, and infectious diseases to repairing various parts of the body, the potential applications of cell therapies are exciting sponsors, investors, and patients. In this article, we review how the number of cell therapy trials has increased steadily over the last five years. Chimeric antigen receptor T (CAR-T) cell therapies and stem cell therapies account for the majority of clinical trial growth, but T-cell receptors (TCR) and tumor-infiltrating lymphocytes (TIL) continue to make advances, as seen in the image below. Our analysis leverages data available from Citeline’s Trialtrove platform, which allows us to examine start dates, indications of focus, mechanisms of action, and other pertinent variables to determine where cell therapy clinical research has been and where it’s going today.

CAR-T therapies are predominantly researched in the oncology patient population, while stem cells are tested in a broader segment of patient populations, including CNS, autoimmune, metabolic/endocrinology, and cardiovascular. Of note, in 2020, the small decrease in CAR-T trials was offset by a larger increase in trials (100+) testing stem cells against coronavirus (as seen in the image below). As you read on, we will break down the current cell therapy clinical research landscape, so you may better understand this rapidly growing environment.

Cell Therapy Trials by Start Date

Cell Therapy Trials by Start DateExamining Cell Therapy Clinical Trials by Trial Phase

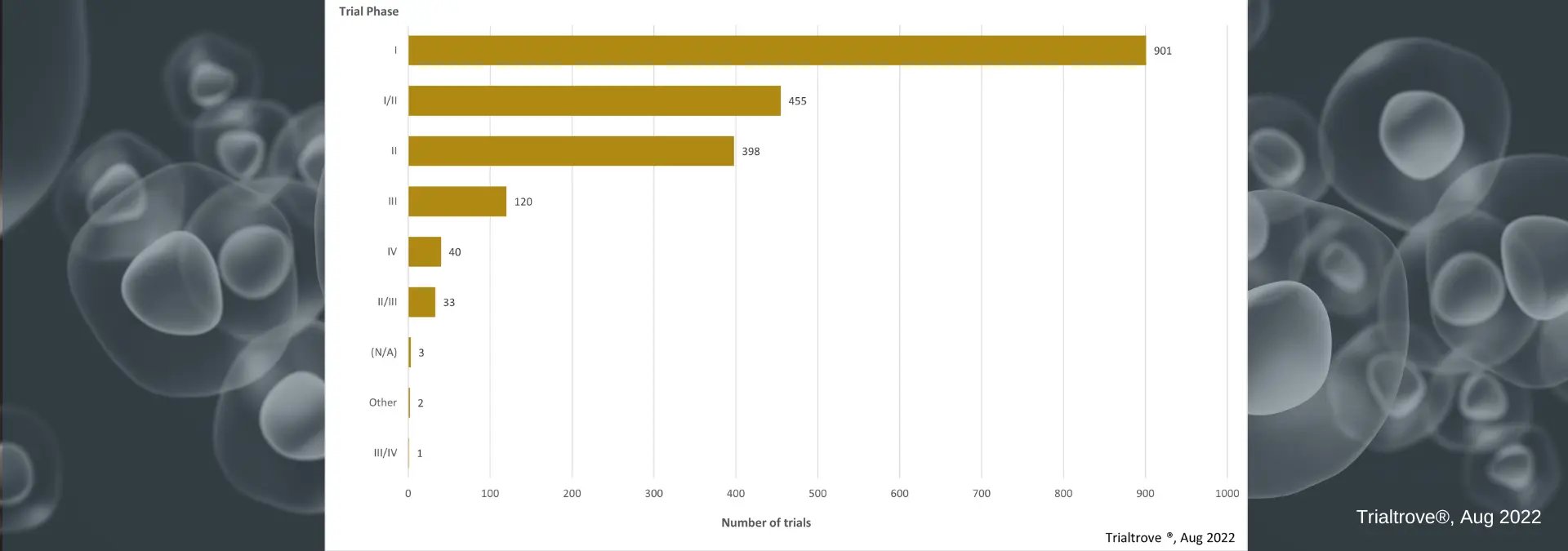

Examining cell therapies by phase, we see a total of 901 clinical trials. With Trialtrove, we can dive deeper into that phase I number to see that there are 417 Phase I trials presently open and an additional 200 with status set to ‘planned’. The other trials under Phase I then fall into 133 completed and 91 terminated with the rest labeled ‘closed’ or temporarily closed.

Additionally, in the graphic below, we see high usage of Phase I/II combination studies. This design approach continues to see increased use across the industry as it helps sponsors to more efficiently optimize and expedite their clinical development programs. Precision for Medicine, as a global CRO, often helps sponsors execute these complex designs and recently wrote an article on best practices for combination study designs in Oncology, which may assist you and your planning.

Cell Therapy Trials by Phase

Cell Therapy Trials by PhaseThe Current Pipeline of Cell Therapy Trials by Status

Thanks to Citeline’s team of dedicated analysts and the Trialtrove platform, we know there are more than 850 open cell therapy trials with another 374 trials planned (Trialtrove® JAN 2022–AUG 2022). When examining next-generation personalized medicine clinical development, we can easily see that the cell therapy market is robust and growing year over year. This is also true for the gene therapy market, which we recently analyzed here. When comparing the two markets, gene therapy has 128 open clinical trials compared to the 850+ cell therapy trials. Both markets are growing rapidly and are expanding into various therapeutic areas.

.webp?width=1920&height=675&name=Cell%20Therapy%20(2).webp) Cell Therapy Trials by Status

Cell Therapy Trials by StatusTop Therapeutic Areas with Open Cell Therapy Trials

With CAR-T’s initial approval in Oncology, current clinical research is still predominantly focused on hemolytic malignancies while also expanding research into solid tumor applications. Also, we’ve seen cell therapy research move into more chronic indications found in autoimmune/inflammation and metabolic/endocrinology, among others. However, as the graphic below shows, cell therapy research in all forms still has 70% of all clinical research focused on oncology applications.

%20(1).webp?width=1920&height=675&name=Cell%20Therapy%20(2)%20(1).webp) Open Cell Therapy Trials by Therapeutic Area

Open Cell Therapy Trials by Therapeutic AreaThe Top 20 Diseases with Open Cell Therapy Clinical Trials

To no surprise, we see hemolytic malignancies with the most cell therapy trial activity driven by the past success of CAR-T therapy in these indications. This is followed by a diverse range of solid tumors. Outside of oncology, coronavirus continues to command a large number of open clinical trials. It will be interesting to see if this indication remains a focus area for the cell therapy sector.

In regard to chronic conditions, osteoarthritis and diabetes follow. Of note, diabetes is not depicted in the image below, but when adding Diabetes 1, 2, and related complications there are over 22 open cell therapy trials. Remember, when a pharma or biotech is pioneering a new therapy, starting HEOR planning in the early phase of the program is vital. Precision’s HEOR team has a long history of success supporting value demonstration for investigational products that are often first to market.

.webp?width=1920&height=675&name=Cell%20Therapy%20(1).webp) Open Cell Therapy Trials by Disease

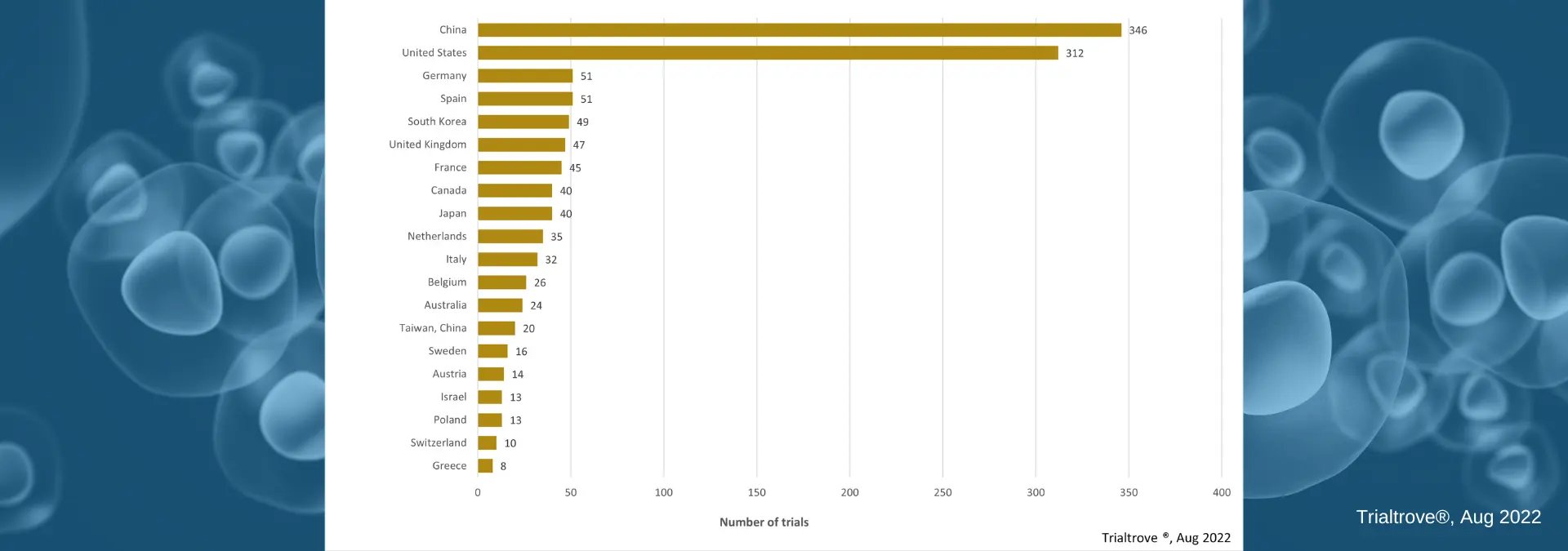

Open Cell Therapy Trials by DiseaseTop 20 Countries with Open Cell Therapy Clinical Trials

China, as seen in the image below, is the current leader in the number of open cell therapy clinical trials. If you actively work in cell therapy, this is not a surprise. However, if you are new to this space or simply conducting research on this topic, then you may be unaware of the recent investment by China-based biopharma in cell therapy (and specifically CAR-T) development.

Open Cell Therapy Trials by Country

Open Cell Therapy Trials by CountryConclusion & Access to Citeline Data

The cell therapy field is broad and growing with a diverse landscape of potential new therapeutics in oncology, autoimmune disease (transplantation of mesenchymal stem cells in patients with various diseases like lupus nephritis, osteoarthritis, ulcerative colitis, and COPD), and CNS (spinal cord injury, ALS, DMD, Parkinson’s Disease, Alzheimer’s Disease, and autism).

We want to thank the dedicated team of analysts at Citeline, without whom this analysis could not have been completed.

If you are interested in digging further into the analysis of the above information, you can do so by leveraging this link to the Trialtrove® research.

- Please note that Citeline Trialtrove® is a paid platform, and a user subscription is required.

- Also, please be aware that Trialtrove® is a live and dynamic platform and that the data we shared as of 15 AUG 2022 changes on a real-time basis.

Navigating Gene Therapy Clinical Research & Commercialization

The realization of next-generation cell and gene therapies calls for more specialized support.

Through Precision Cell & Gene, your next project can take advantage of an intelligently designed combination of clinical, manufacturing, and commercialization solutions specific for cell and gene therapy development.